The rise of artificial intelligence has changed our world completely—sparking impressive advancements and opening doors to countless possibilities. Yet, as we continue in this AI-centric era, we need to be prepared for the unexpected pitfalls it might bring—especially those that could have a significant financial impact.

As an independent insurance agent, your clients trust you to safeguard their interests. In today’s world where technology isn’t just nice-to-have, but a must-have, it’s essential to understand the implications of AI and the potential risks it brings to your clients. What was once only imaginable in sci-fi movies is now a part of our daily lives, and with it, there’s a new set of challenges and risks you need to address.

Scams can abound

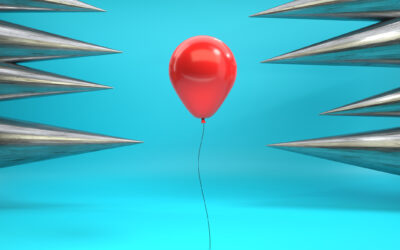

It’s a wild world out there. Imagine grandma being fooled by a voice that sounds just like her grandkid, or minors chatting with bots that have no business talking to them. Even the handy QR codes you scan without a second thought can lead you into a trap. The reach of AI into the shady side of things is a hard truth we can’t ignore. These threats are crafty, playing on our natural instincts to trust and connect, and it often catches people off guard.

AI’s tricks don’t stop at just sounding like someone else. It now can make an image that looks exactly like a real person. Picture this: You’re on a business Zoom call, and the person you’re talking to isn’t even real—it’s a deepfake (i.e., an AI-generated version of the other person, that looks and sounds just like that person). Your client could easily give away sensitive information without realizing who’s on the other side, causing a big financial mess and potentially even damaging their reputation.

Where’s the protection?

So, who picks up the pieces after such a high-tech scam? Who’s there to cover the loss?

This is where insurance agents come into play. The landscape of threats is changing, and the insurance industry needs to keep pace. This new arena of AI fraud isn’t just a hurdle; it’s a chance to innovate and create insurance solutions that address these new risks.

Being an independent agent puts you on the front lines. Your understanding of AI threats is your shield. It’s time to bring your clients up to speed about AI risks and how insurance can help protect them. And don’t forget, keeping updated with cyber security trends is essential to ensure your insurance offerings are top-notch and fully relevant.

The beauty of being an independent agent is your ability to move quickly. You can adapt to emerging threats faster than the big players—offering your clients comprehensive coverage that meets their needs.

In the end, while the rise of AI might seem a bit overwhelming, it also opens doors for growth and fresh ideas within the insurance industry. The agents who can navigate this new landscape, tackle the new challenges, and understand the emerging threats will surely stand out from the crowd. So, let’s embrace this change, fill up on knowledge, and step into the future of insurance, together.

Amir Sachs

Amir Sachs, founder and CEO of Blue Light IT in Boca Raton, Fla., helps small- and medium-sized companies around the globe reduce the risk of cyberattacks. Co-author of the Amazon Best-Sellers: Cybersecurity NOW, Crucial Strategies from 11 IT Security Experts and Managing Your Business Risk in the Cybersecurity Minefield, Sachs has more than 25 years of experience in the small- and medium-sized enterprises across multiple industry sectors and founded Blue Light IT in 2003.