According to the Insurance Information Institute, the insurance industry is seeing more economic momentum in U.S. auto, home, and business insurance than the entire U.S. economy. Mortgages and other personal loans will cost less, allowing for economic development in the insurance industry. Specifically, Triple-I anticipates insurer underlying growth to equal then surpass the GDP at a rate of 3.5% by the end of 2023. America’s economy is up from last year’s 2.6%, however it is likely to stay closer to 3.2%.

Inflation continues to decrease in 2023

In January 2022, the inflation rate had reduced to 6.5%. Other phenomena like global weather- related disasters have contributed significantly to major losses in the marketplace. Whether it is the war in Ukraine or the ongoing global COVID-19 pandemic, there is supply-demand disparity in the property catastrophe marketplace.

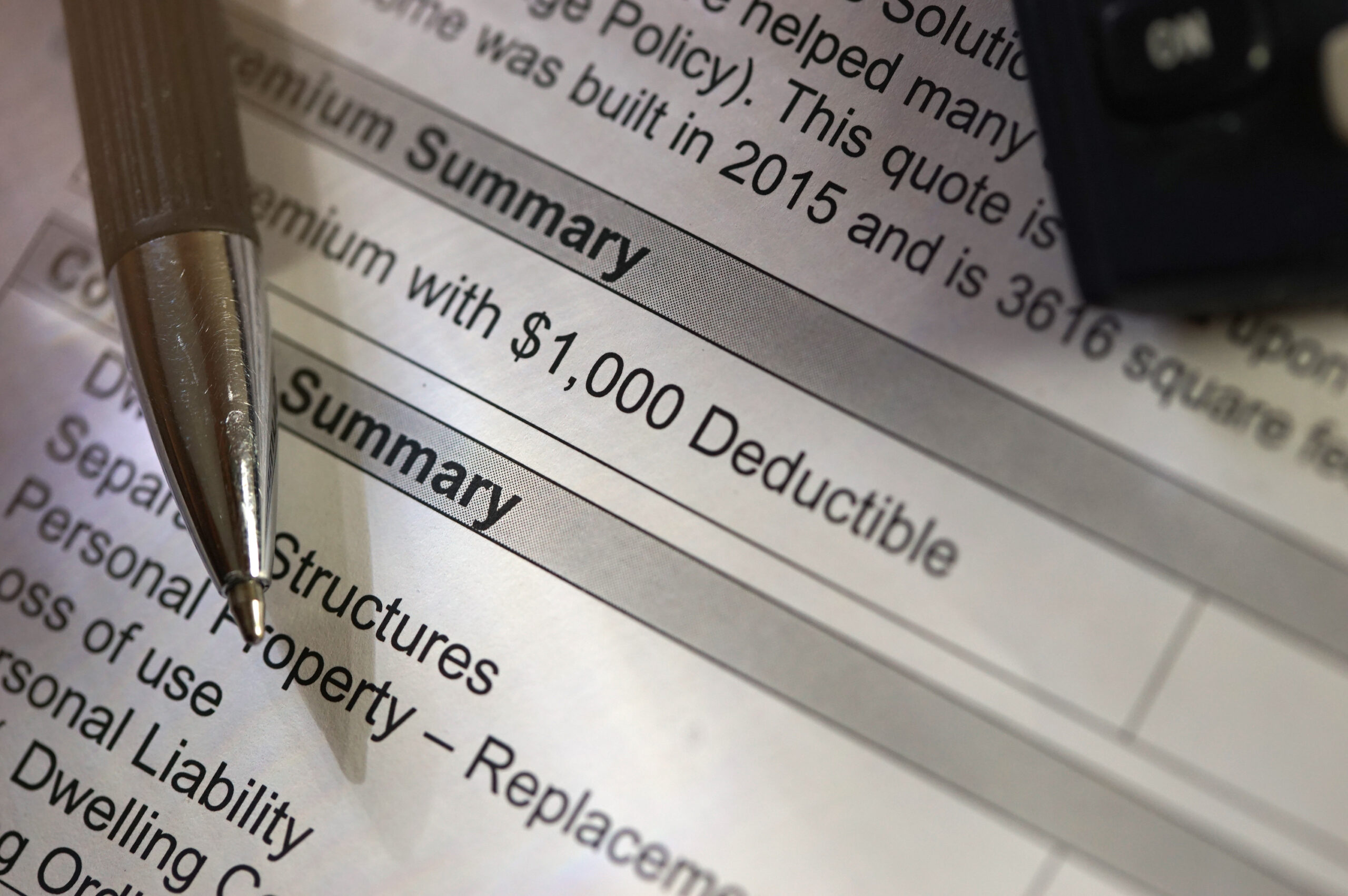

Unfortunately, this does mean that customers will experience higher premium costs across the nation. As hurricane seasons continue to be more severe, this trend is likely to continue. For example, insureds in Florida have seen astronomical rate increases based solely on Hurricane Ian and Nicole. Currently, Florida is in litigation specific to the two natural disasters, and it is has placed 19 insurance companies on its watch list, which may be indicative of possible trends across the U.S.

Regardless of newly enacted legislative reforms, Floridians are likely to see their insurance premiums swell even more than 40% in 2023. The National Association of Insurance Commissioners recently published the Property Insurance Stability Report, showing that Monroe, Broward, and Miami-Dade counties are the most costly counties to live in in Florida.

Maura Rosner

Maura worked as a reporter for the Daily Mail. She received her English, B.A., from Brooklyn College. Maura is also a photographer who believes that there is power in every image.