Vertical specialization—where insurance producers focus on specific industry sectors, niches or lines of business—is quickly gaining ground as an approach for accelerating growth. It has proven to enhance client retention, build efficiency and foster innovation—leading to a competitive advantage and better business growth.

Benefits of specialization

The insurance industry is facing a hardened rate environment, and market access challenges due to escalating risks—like extreme weather events or cybercrime. In addition, the insurance workforce is declining and there’s an ongoing battle for talent. Many agents and brokers who are considered generalists are starting to experience limitations with that approach as clients seek those with deeper knowledge around specific industries and risks.

Here are some insights into specialization and why more agents and brokers are using it to help drive growth and expand their business:

Improve client relationships. When you choose a specific niche, you’ll move from being perceived as a vendor to someone who is a strategic resource. Specializing allows you to better understand your clients’ needs, risksandquestions. It also helps you get better at recommending coverage, risk management strategies, and implementation of tools and resources that address their unique needs. As your expertise grows, you’ll also attract the right clients and offer a better overall client experience.

Drive organic growth. When your clients are satisfied, they are more likely to retain your services, buy additional products and recommend you to others. You also can target your marketing to more specific industry publications, trade associations and network groups. With specialization comes endless opportunities to showcase your authority and expertise.

Increase efficiency. Spending time in one sector saves time and money since you can focus on those industries that yield the best results. When all your clients are similar, you tend to work with just a few carriers, policy types, resources or contacts. This efficiency also leads to better productivity in your producers and other staff.

Strengthen industry relationships. Focusing on a singular niche can strengthen communication and relationships with carriers that specialize in specific types of businesses. For example, carriers might be more willing to create a special program for an agent due to the amount of business he or she brings to the company. Building positive relationships with industry associations and groups also generates more business for an agency.

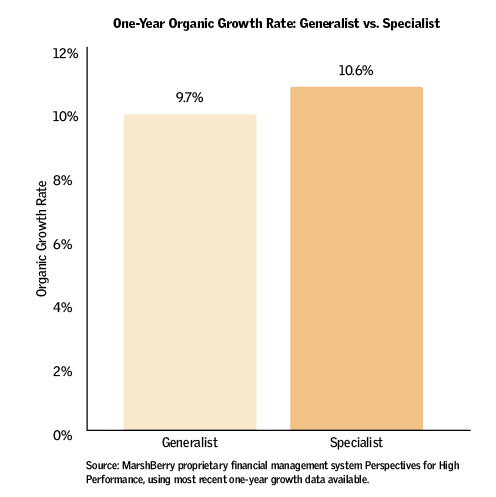

Stay competitive. Serving specific industries (instead of all industries) means competing with a smaller pool.Differentiating your business by delivering tailored products can enhance your place in the broader market. If you remain a generalist while others are specialized, it may be tougher to bring in new business. In fact, most of the insurance brokerage world has shifted toward this model and, according to our research, specialists grow at a faster pace than generalists.

How to find your specialty

Establishing expertise within one or more industry verticals is a key ingredient to specialization. When planning your insurance specialization, start by looking at your existing book of business. You may find you already write a few firms in a similar industry. This is a good place to start. Alternatively, what business is in your footprint to write? Restaurants? Agriculture? Hospitality? Nonprofit? Many agencies and brokerages have industry vertical specialization but they don’t know it. The fact is—if you write one nonprofit you are a generalist. But if you write two, you are an expert. Use the power of your diverse client base and the data you capture and maintain to drive industry vertical expertise within your firm.

Consider your business’s strategic goals, expertise and market opportunities to choose a niche in which you can make a difference. Then, look for patterns. Find sectors that have more consumers, emerging risks or unique needs.

Perhaps you’re passionate or personally experienced in a particular niche. Look at the unique talents, interests and backgrounds of your producers. Do they possess any unique skills or knowledge, like language or cultural background? This can energize your producers, making them more satisfied in their specialized roles for bringing in new customers.

Most importantly, assess your progress as you go to ensure you’ve selected the right industry. Don’t feel committed to one area permanently—you can adjust based on results, or if another vertical presents an opportunity that better fits your skills.

Best practices for specialists

Shifting your business to be more specialized will take some careful strategizing. The first step is to build your knowledge in your targeted industry or line of business. Reach out to carriers that specialize in those areas and get their insights on the industry. Some carriers prefer to work with specialized agents and offer training seminars on industry topics. Get the right talent onboard to provide service to these clients and to enhance your agency’s credentials even further. Then, create a targeted marketing strategy by placing ads on the platforms your clients use most.

Staying knowledgeable long-term is key. Explore events, compliance changes and new challenges that currently impact your vertical. Staying one step ahead will demonstrate your expertise to clients.

Specialization is no longer a nice-to-have—it’s a necessity for differentiating and competing in this business. Vertical specialization offers your clients customized solutions and deeper expertise, and it will help your business move from a transactional relationship to a consultative business partner that clients can trust.

This article originally appeared in the November 2024 issue of PIA Magazine.

Brian Refici

Brian Refici joined MarshBerry in 2021 as a vice president within MarshBerry’s Financial Advisory team. His current responsibilities include acting as a client-facing lead on merger & acquisition and financial consulting projects, developing strategy and implementation of client deliverables, and recognizing opportunities for growth that ultimately enhance client satisfaction. Founded in 1981, MarshBerry is a global leader in financial advisory and consulting services serving the insurance brokerage and wealth management industries to help clients grow and advance their business strategies. With locations across North America and Europe, MarshBerry market sector expertise includes property/casualty agents & brokers, employee benefit firms and specialty distributors, partners in InsurTech, capital markets, and insurance carriers, as well as registered investment advisers, retirement planning and life insurance firms. Clients choose MarshBerry as its trusted adviser for every stage of ownership to help them build, enhance and sustain value through Financial Advisory solutions (Investment Banking; Merger & Acquisition Advisory, Debt & Capital Raising, Business Consulting), Growth Advisory solutions (Organic Growth, Aggregation, Leadership, Sales & Talent Solutions) and Market Intelligence and Performance Benchmarking.