PIACT members and staff testified before the Connecticut General Assembly’s Insurance and Real Estate Committee in strong support of H.B.6981 on Feb. 27, 2025. This legislation would remove the due-diligence requirement for placing risks in the nonadmitted insurance market when done through an unaffiliated surplus-lines broker.

PIACT was represented by Treasurer Kathleen Bailey, CPIA, ACSR, CLCS; past President James Berliner, CPCU; Member Raymond Chase, CLCS; and PIACT Director of Government & Industry Affairs Bradford J. Lachut, Esq.

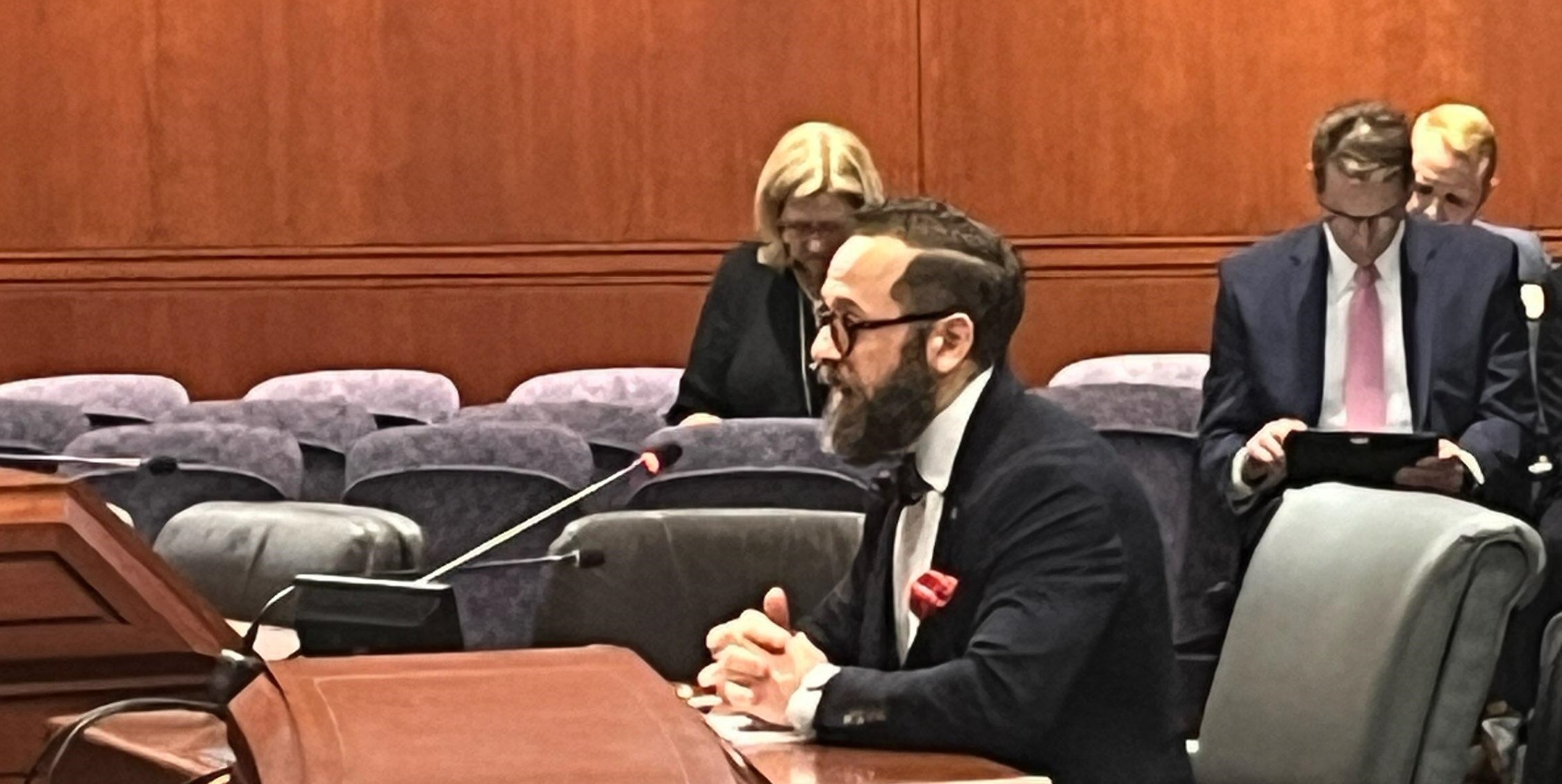

[PHOTO CAPTION: PIACT Director of Government & Industry Affairs Bradford J. Lachut, Esq. providing testimony to the Connecticut General Assembly, with people seated in the background.]

Why H.B.6981 matters

The bill would streamline the excess-and-surplus lines insurance process, which would make it easier for Connecticut businesses to secure specialized coverage without unnecessary regulatory delays. In their testimony, the PIACT representatives emphasized that this measure would modernize the insurance market while maintaining strong consumer protections.

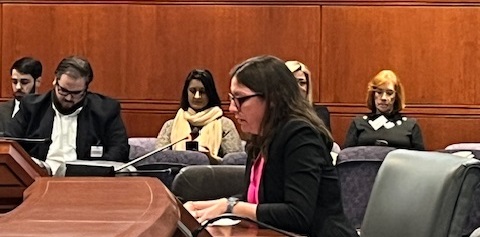

[CAPTION: PIACT Treasurer Katie Bailey, CPIA, ACSR, CLCS providing testimony to the Connecticut General Assembly, with people seated in the background.]

Currently, Connecticut law requires insurance brokers to obtain declinations—formal rejections—from admitted insurers before securing coverage in the E&S market. However, this requirement often serves as an unnecessary administrative hurdle rather than a meaningful safeguard. Brokers, who are already highly trained professionals, often know in advance that admitted insurers will not cover certain risks. The current requirement only delays access to crucial coverage and increases administrative costs for brokers and policyholders.

The role of the E&S market

The E&S insurance market plays a crucial role in protecting businesses and individuals who cannot secure coverage from standard (admitted) insurers. It provides solutions for high-risk, unique or emerging risks, ensuring that businesses can operate without financial vulnerability. However, to remain effective, the E&S market must operate efficiently and without unnecessary bureaucratic barriers.

Eliminating outdated regulations

PIACT argues that the due-diligence requirement no longer serves its intended purpose. It forces brokers to collect declinations from admitted carriers—even when it is clear those carriers will not provide coverage. The result: delays, increased costs and frustration for brokers and policyholders.

[CAPTION: PIACT Member Ray Chase providing testimony to the Connecticut General Assembly, with people seated in the background.]

Additionally, other states already have eliminated similar requirements, including Louisiana, Mississippi, Virginia and Wisconsin. These states have proven that removing the due-diligence requirement improves efficiency without reducing consumer protections.

Connecticut risks falling behind its peers if it does not modernize its approach.

Consumer protections remain strong

While H.B.6981 removes an administrative burden, it does not reduce consumer protections. Key safeguards remain in place:

- Consumers would not directly access the E&S market—they must go through a licensed insurance broker.

- Brokers would still be ethically and professionally obligated to place policies in the admitted market first whenever possible.

- Financial incentives already encourage brokers to use admitted carriers first, as E&S placements often involve commission splits and additional administrative complexities.

What comes next

With the hearing concluded,General Assembly’s Insurance and Real Estate Committee will now take time to considered all of the testimony prior to voting on whether the advance the measure.

Take action!

Do you have thoughts on any of these proposed bills? Let PIACT know how they would impact your agency and your clients, email govaffairs@pia.org.

Keep updated on PIACT’s legislative updates on PIA Northeast News & Media. And, review your association’s legislative priorities for 2025.

Be active! Are you interested in helping your association advocate for issues that are important to the insurance industry and the insurance-buying public? Take part in PIACT’s District Office Visits program.

Bradford J. Lachut, Esq.

Bradford J. Lachut, Esq., joined PIA as government affairs counsel for the Government & Industry Affairs Department in 2012 and then, after a four-month leave, he returned to the association in 2018 as director of government & industry affairs responsible for all legal, government relations and insurance industry liaison programs for the five state associations. Prior to PIA, Brad worked as an attorney for Steven J. Baum PC, in Amherst, and as an associate attorney for the law office of James Morris in Buffalo. He also spent time serving as senior manager of government affairs as the Buffalo Niagara Partnership, a chamber of commerce serving the Buffalo, N.Y., region, his hometown. He received his juris doctorate from Buffalo Law School and his Bachelor of Science degree in Government and Politics from Utica College, Utica, N.Y. Brad is an active Mason and Shriner.