Multiple factors influence the health of the insurance business. This report delves into insurance industry performance, growth potential, and specific trends generating wins—or causing concern. [EDITOR’S NOTE: This article is a follow-up to Brian Refici’s presentation for PIANJ’s recent Deep Dive Live.]

Macroeconomic factors and the marketplace have created favorable conditions for the insurance industry (as a whole) leading to strong, consistent profitability. While the industry continues to offer benefits like stability, recurring revenue and a robust secondary market, new challenges have emerged that can impact the insurance business negatively and create additional risk.

Macroeconomic factors

Interest rates, economic growth, leverage ratios, rate environment, the political landscape and tax rates all contributed to a profitable 15 years for the insurance industry as a whole. Many experts consider this a supercycle (i.e., a prolonged period of economic expansion).

Evidence of a supercycle includes the following:

- long running GDP growth,

- a lengthy property/casualty hard market,

- extreme revenue growth for specialty platforms, and

- overwhelming demand from investors.

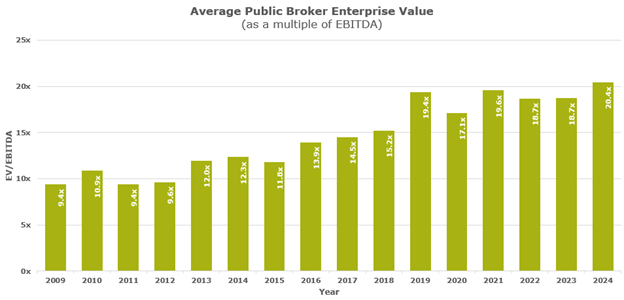

In fact, investor interest in public brokers has grown significantly since 2009. The number of active private equity funds investing in public brokers has increased from 13 funds in 2008 to 103 funds in 2024.[1] This rising interest and investment has contributed to enhanced public broker valuations.

Another attractive feature for investors is that insurance remains one of the most stable industries, with less volatility than most other industries (as measured by the beta of the industry), including IT, construction and health care.

A robust marketplace

Last year delivered positive metrics for the insurance industry across the board:

- Although 2024 numbers are still being finalized, the industry expects a sub 100 combined ratio due to the strong earnings from the major carriers, as well as brokers.

- Premium rates increased between 8-10% across most lines, helping firms’ organic growth rates and profitability.

- Reinsurance markets experienced a comeback with total reinsurance capital rising to approximately $607 billion in 2024.

- Specialty lines experienced an uptick in insurance premiums, and they are expected to continue growth momentum into 2026 and beyond.

- Technology spending has increased steadily since 2018 both on the carrier and broker side, including AI-powered platforms and claims processing technology.

Potential headwinds

Despite the tailwinds experienced in 2024, the industry still is facing some potential hurdles. Weather patterns are shifting, leading to more frequent and more severe storms, floods, fires, among other billion-dollar weather events. Nuclear Verdicts® (exceptionally high jury awards in excess of $10 million) are affecting everything from pricing and underwriting to client relationships. Then, there’s the risks that may become uninsurable in the future. Things like natural disasters due to climate change, or supply-chain distribution issues, could cause such substantial damage that providers reduce or remove coverage.

While the insurance market is profitable overall, there are some specific lines experiencing a softer market such as medical malpractice, business interruption insurance and directors & officers liability coverage.

What can insurance producers control?

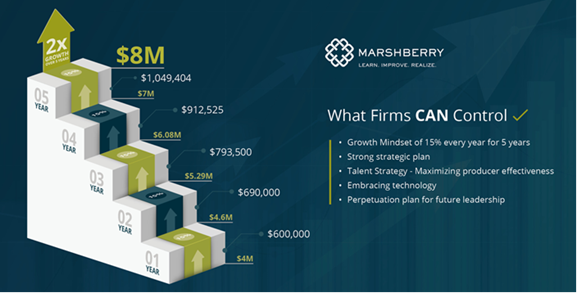

While macroeconomic factors and the marketplace are uncontrollable, there are things that agents and brokers have control over. If a firm wants to double its value in the next five years, as high growth firms do, MarshBerry recommends using the Rule of 72. This formula is used to determine how long it takes to double an investment. To double a firm’s value in five years requires 15% growth every year.

It starts with adopting a growth mindset and creating a strong strategic plan. Firms that have a talent strategy (including addressing the challenges of nonproducing producers and investing in unvalidated producers), embrace technology and have a perpetuation plan for future leadership, will be able to reach those growth goals, no matter where the market goes next.

[1] MarshBerry Proprietary Database, Pitchbook, Insurance Journal and other publicly available sources. Data as of Dec. 31, 2024.

Brian Refici

Brian Refici joined MarshBerry in 2021 as a vice president within MarshBerry’s Financial Advisory team. His current responsibilities include acting as a client-facing lead on merger & acquisition and financial consulting projects, developing strategy and implementation of client deliverables, and recognizing opportunities for growth that ultimately enhance client satisfaction. Founded in 1981, MarshBerry is a global leader in financial advisory and consulting services serving the insurance brokerage and wealth management industries to help clients grow and advance their business strategies. With locations across North America and Europe, MarshBerry market sector expertise includes property/casualty agents & brokers, employee benefit firms and specialty distributors, partners in InsurTech, capital markets, and insurance carriers, as well as registered investment advisers, retirement planning and life insurance firms. Clients choose MarshBerry as its trusted adviser for every stage of ownership to help them build, enhance and sustain value through Financial Advisory solutions (Investment Banking; Merger & Acquisition Advisory, Debt & Capital Raising, Business Consulting), Growth Advisory solutions (Organic Growth, Aggregation, Leadership, Sales & Talent Solutions) and Market Intelligence and Performance Benchmarking.