You are probably familiar with the turn of phrase Don’t shoot the messenger. It means not to blame the person delivering a message for the content of that message. Often, I think that all insurance agencies should have that sign up in their lobby or on their website, as a notice to customers.

The independent insurance agent is the best—and often only—connection policyholders have to the world of insurance. So, when something happens to their policies, they are apt to blame any bad news on the messenger: their insurance agent.

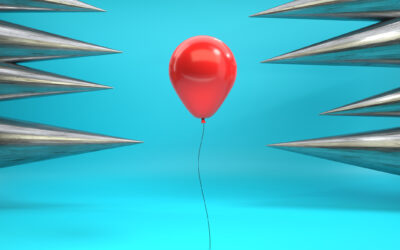

With premiums and nonrenewals currently on the rise across almost all lines of insurance nationwide, how is an agent supposed to deal with delivering the bad news? All an agent can really do is help to explain the facts behind why policyholders are experiencing what they are experiencing. While the answer to that question is complex, as an agent you don’t have to tell the complete story, only the most relevant to the policyholder.

Pump it up

Let’s start with the most obvious, at least for the policyholder, and that’s with inflation. That is a concept we are all painfully familiar with at this point. Inflation is the rate at which prices for goods and services increase. As I wrote in the March 2023 issue of PIA Magazine, inflation in America reached 20-year highs in 2022. Which means the cost of many goods and services were similarly high. Policyholders may ask how inflation impacts their insurance premiums when they still are purchasing the same level of coverage. Ignoring the fact that the risk may be underinsured now—a topic for another article—inflation means that the cost of replacing the risk, be it a vehicle, house or business is now more than it would have been during the previous policy terms.

Increasing interest (rates)

A policyholder might say, “Okay, I understand why inflation might increase premiums for policies that cover property, but what if I have a liability-only policy?” Good question. That brings us to the next talking point: increasing interest rates.

The Federal Reserve is the central banking system of the United States, and in a grand sense oversees making sure the country’s economy continues to have sustainable growth. When the economy gets funny—like when inflation increases sharply—the Fed will use the main tool in its toolbelt to address it: adjusting interest rates. The Fed has been increasing rates steadily for the last year. Where there was 0% interest rate for much of the pandemic, interest rates currently sit around 5%.

How do interest rates impact premiums and risks that an insurance company will write? Here it’s time to acknowledge a hard truth: insurance companies are businesses and businesses exist to make money. It’s OK to admit that. America is a capitalist society; generally, profitability is encouraged. So, how do insurance companies make a profit? Insurance companies make money differently depending on the state of interest rates and the economy. When interest rates are low, profitability comes from investments.[1] Money is inexpensive to borrow, which makes the return on investing that money higher. Insurance companies will write more policies to take in more premium dollars, which they can turn around and invest. Even it if means paying out more in claims than a company takes in in premium.

However, the script flips when interest rates increase. When the cost of borrowing money increases, the return-on-investment decreases. Insurance companies are no longer looking to make money on investments. Instead, they are looking to make money on the risks they insure. To be profitable, an insurance company will be more sensitive to the cost of claims exceeding the premium received. Insurance companies address this in several ways, including increasing premiums or decreasing exposures by either lowering limits or canceling risks outright.

Introducing reinsurance

The last talking point is perhaps the one that is most unfamiliar to policyholders. Heck, it is unfamiliar to many insurance agents! That is the concept of reinsurance. While reinsurance is likely a foreign concept to policyholders, at least at a high level, is a relatively easy concept to understand. It mirrors the policyholder’s own insurance experience. Reinsurance is nothing more than insurance for insurance companies.

Insurance, at its base level, is a contract to transfer risk. In typical insurance settings, a policyholder agrees to pay a premium to an insurance company to transfer the risk of paying for a future loss to said company. Reinsurance is the same concept. An insurance company purchases reinsurance to transfer some of the risk of the future loss to another party.

Just like inflation and high interest rates have caused premiums for regular insurance to increase, so to have they made premiums for reinsurance increase. There are now fewer reinsurance dollars to go around to insurance companies. In turn, insurance companies will limit their exposure by being more selective in the risks they write, as well as how much they are charging for those exposures.

I am not naïve enough to think that talking about reinsurance and economic policy will quell the angriest policyholder. However, being able to understand—and more importantly explain—the reasons why a policyholder with no significant claims history is experiencing a 20% rate increase is critical.

It allows you to not only deliver a message, but it will elevate you from merely a messenger to a trusted adviser.

This article originally appeared in the June 2023 issue of PIA Magazine.

[1] It’s appropriate here to mention that there is obviously a lot of nuisance to how businesses make money, which I’m ignoring for the sake of brevity and our collective sanity.

Bradford J. Lachut, Esq.

Bradford J. Lachut, Esq., joined PIA as government affairs counsel for the Government & Industry Affairs Department in 2012 and then, after a four-month leave, he returned to the association in 2018 as director of government & industry affairs responsible for all legal, government relations and insurance industry liaison programs for the five state associations. Prior to PIA, Brad worked as an attorney for Steven J. Baum PC, in Amherst, and as an associate attorney for the law office of James Morris in Buffalo. He also spent time serving as senior manager of government affairs as the Buffalo Niagara Partnership, a chamber of commerce serving the Buffalo, N.Y., region, his hometown. He received his juris doctorate from Buffalo Law School and his Bachelor of Science degree in Government and Politics from Utica College, Utica, N.Y. Brad is an active Mason and Shriner.