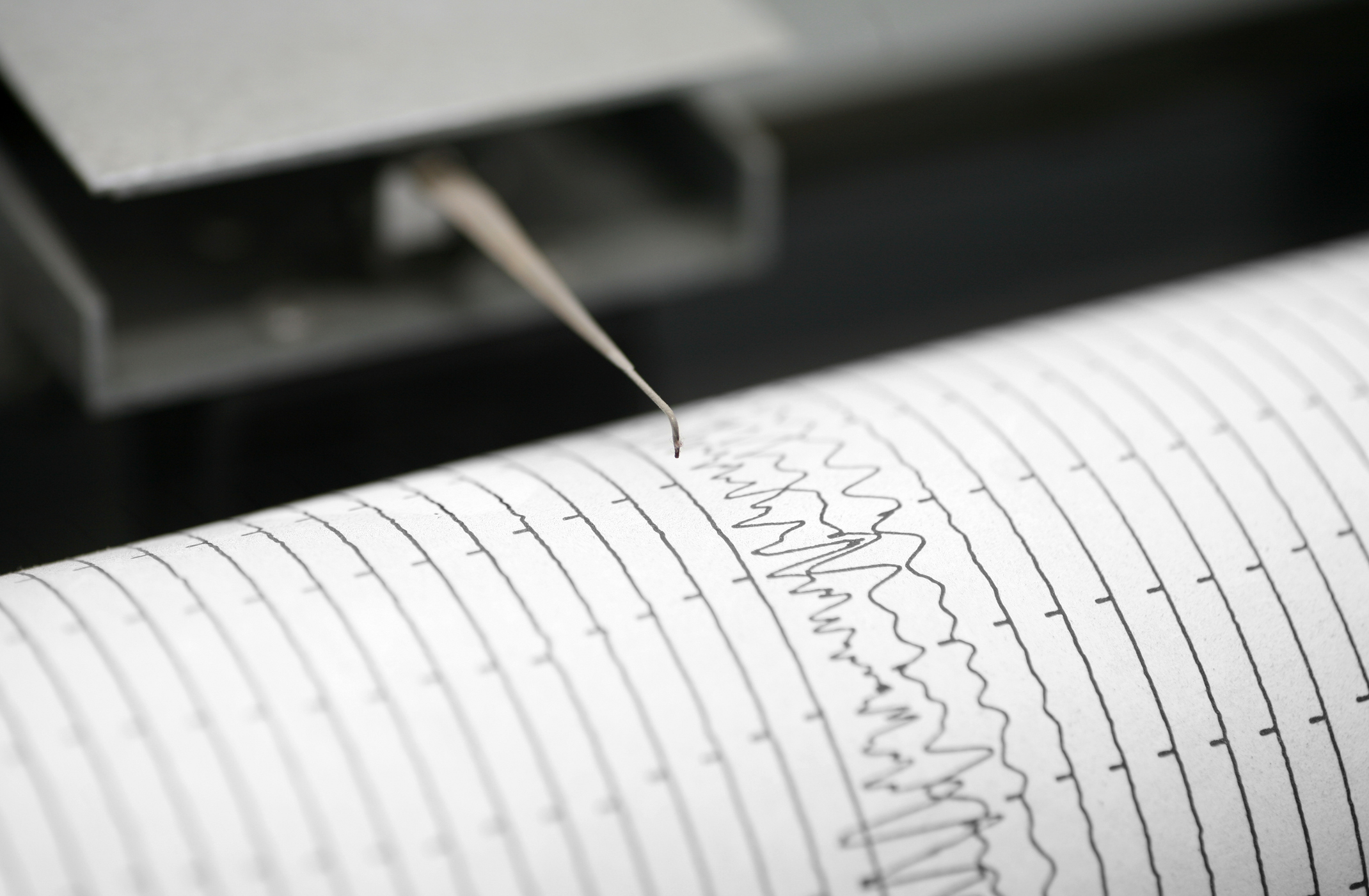

On Friday, many Northeasterners felt the effects of a 4.8 magnitude earthquake, which rocked our world with shaking buildings from Philadelphia to New Jersey to New York City to Connecticut to Westchester, N.Y. The earthquake was centered near Whitehouse Station, N.J., according to the U.S. Geological Survey.

The thing that many do not realize is that major fault lines run through the Northeast. The most active fault lines run through New York City into New Jersey and from the northern end of the Adirondacks into Quebec and Ontario. There are also fault lines in western New York and in the southern Adirondacks that run north of Schenectady into the Mohawk Valley.

With any event like this comes the insurance questions

Now that your clients—both personal and commercial insureds—just experienced the earth moving under their feet, you will be sure to receive this question: Can I purchase earthquake insurance coverage now?

If there’s been a recent earthquake, most insurers won’t sell any new earthquake insurance policies for 30 to 60 days since there may be damaging aftershocks within that period of time.

To assist you in educating your clients and potential clients about earthquake coverage, PIA offers two consumer flyers you can share with them:

- Earthquake coverage not included in homeowners insurance policies; and

- Earthquake coverage not included in business insurance policies.

For a copy of either of these resources, contact PIA’s Industry Resource Center at resourcecenter@pia.org.

Insureds who experienced damage

If your insureds received any damage to their home or business and they have earthquake coverage currently, encourage them to submit a claim—even if they don’t think the damage to their home or business is greater than their deductible. A qualified professional should inspect their home or building for both structural (hidden) and cosmetic damage. The inspection should include the attic, basement, walls, foundation and chimney.

Shirley Albright, CPIA, CISR

Shirley Albright, CPIA, CISR, has been a cornerstone of PIA since joining the association in 1983. Over the decades, she has contributed meaningfully across numerous departments, demonstrating unwavering dedication and leadership. In 1995, Shirley played a pivotal role in launching the Industry Resource Center, where she led the development of a comprehensive software system designed to log and manage all incoming and outgoing member inquiries—an innovation that transformed the center’s operational efficiency. As director of the Industry Resource Center, Shirley oversees the center’s daily operations, including the triage and resolution of thousands of member inquiries and multiple database updates, ensuring timely and accurate support across the organization. Her industry accomplishments include earning her New York state property/casualty broker’s license and has obtaining the CPIA and CISR professional designations, underscoring her deep expertise and commitment to excellence in the insurance industry.