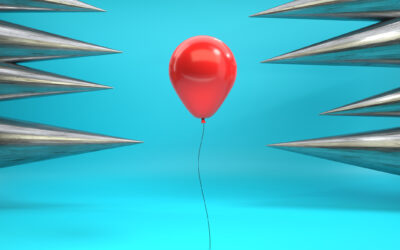

Insuring on a stated amount basis usually offers little benefit to the insured. From the insured’s perspective, a few things can go wrong when the stated amount fails to exactly equal the cash value of a property at the time of loss.

One predicament your insureds could find themselves in is the collection of only the cash value when the cash value is less than the stated amount. The problem here: The insured may be expecting to collect the full stated amount.

Another predicament your insured could run into is when the actual cash value exceeds the stated amount and the insured collects only the stated amount.

Agreed amount vs. stated amount

It’s important that the insured knows that the stated amount is not the same as the agreed amount. The limit amount agreed upon is the amount payable regardless of the property’s cash value at the time of loss.

If the stated amount is higher than the cash value of the property, then the insured receives only the cash value of the property and he or she will have paid more than necessary for insurance on it. If the agreed amount is higher than the cash value of the property, then the insured still will be paid the agreed amount.

If the stated amount is lower than the cash value of the property, the insured will receive only the stated amount. If the agreed amount is lower than the cash value, then the insured also receives the agreed amount. Underinsured values can be remedied by obtaining periodic appraisals.

Often, policyholders tend to overvalue their property, which doesn’t accurately depict the true value. It’s important to ensure they understand that more premium must be paid for higher limits.

Exceptions

There are some occasions in which the stated amount could be used to the advantage of the insured. For example:

Suppose your commercial client has a fleet of trucks that depreciated well before their time. Instead of paying physical damage premiums based on their “cost new” and “age group,” you may be able to reduce the premium by insuring them for their depreciated actual cash value on a stated amount endorsement. This could be a win, in which your insured ends up with more satisfaction by serving less coverage for less premium.

To learn more about stated amount coverage, PIA members can access Stated amount coverage in the PIA QuickSource library.

Shirley Albright, CPIA, CISR

Shirley Albright, CPIA, CISR, has been a cornerstone of PIA since joining the association in 1983. Over the decades, she has contributed meaningfully across numerous departments, demonstrating unwavering dedication and leadership. In 1995, Shirley played a pivotal role in launching the Industry Resource Center, where she led the development of a comprehensive software system designed to log and manage all incoming and outgoing member inquiries—an innovation that transformed the center’s operational efficiency. As director of the Industry Resource Center, Shirley oversees the center’s daily operations, including the triage and resolution of thousands of member inquiries and multiple database updates, ensuring timely and accurate support across the organization. Her industry accomplishments include earning her New York state property/casualty broker’s license and has obtaining the CPIA and CISR professional designations, underscoring her deep expertise and commitment to excellence in the insurance industry.