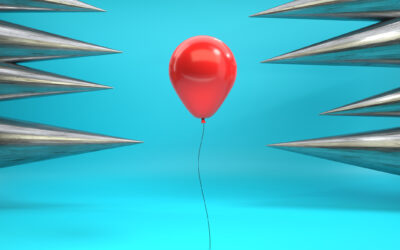

The hard market has been a recurring topic of conversation over the last several months as something impacting insurance producers nationwide significantly. Diving further into the topic, the recent pattern of carrier withdrawals from various markets has become rather alarming—and it has made a difficult problem even more difficult—as producers scramble to find their clients adequate coverage in these carriers’ absences.

Many point to new patterns of extreme weather as the cause of carriers withdrawing from markets. For example, the devastating wildfires in California have caused carriers to rethink risk in the state. The same can be said for Florida and the rest of the Gulf Coast—as hurricanes become even more damaging and routine. Extreme heat impacts the South and middle of the country, and now the Northeast and other coastal states are beginning to see the insurance impacts on premiums and availability due to flooding and windstorms. The consensus is that California, Florida, Texas, Colorado, Louisiana and New York now seem to be the most difficult states to insure a home.[1] Major carriers have been retreating from at-risk areas and small insurers have been driven out by claims that have overwhelmed their finances, leaving many home and property owners to rely on last-resort state programs.[2]

There also are other significant contributing factors besides extreme weather that have been leading to the withdrawal of insurers from certain markets. In fact, the hard-market crisis in certain states is largely connected to human action in the form of frivolous lawsuits and fraudulent claims.[3] Litigation costs have skyrocketed, forcing local, residential-only insurers to become insolvent while driving up premiums and decreasing policy offerings by national insurers.[4] Additionally, insurance carriers have cited increased costs due to inflation as a reason for withdrawal.[5]

The regulatory environment is proving to be less than ideal to help the situation. For example, in California, insurers have been blocked from increasing rates above certain thresholds, which they cite as a reason for their inability to cover costs of their policies.[6] Insurance Information Institute spokesman Mark Friedlander has been quoted as saying that insurance rates have been “artificially low” for decades now, with carriers writing business for very high risk and losing money.[7]

However, it does seem that the federal government is beginning to wake up when it comes to the detrimental impact climate change is having on the nation’s property insurance industry—especially because of the scrutiny it is receiving as premiums have been soaring and at-risk regions are losing carriers.[8] The U.S. Treasury Department, two U.S. senators and a national group of state regulators have launched various inquiries into just why the industry is destabilizing, thus forcing property owners to pay these much higher rates or skip out on coverage altogether.[9] These efforts are being undertaken in the hope that the federal government will be able to better understand how climate change is impacting everyday costs for Americans, as well as develop ways to make property insurance more accessible.[10]

In the meantime, where does that leave us?

Navigating a carrier withdrawal

While the hope is to never be impacted by a carrier withdrawal, recent trends suggest it may be something that will touch your business. When insurance carriers withdraw from a market, there is a range of legal and regulatory considerations insurance producers must keep in mind to protect their agencies and clients. Here are a few things to consider:

Notification requirements. It is essential that insurance producers are aware of the legal requirements in connection with notification—not only to policyholders—but to producers, as well as state regulatory agencies. Many such agencies are concerned with the potential disruptions associated with carrier withdrawal, and in some instances, they have begun to adjust their notification requirements. For example, for both admitted and authorized nonadmitted carriers in Connecticut, Bulletin PC-34-23 issued in September 2023 updated and replaced prior stipulated notification requirements for carriers seeking to discontinue or substantially reduce “its writings in a line or subline of property and casualty insurance.”[11]

Regulatory compliance. Every state has its own insurance regulations. Therefore, it is critical that producers remain updated on them and in compliance when a carrier exits a market. This includes knowing any state-specific rules for each state in which you conduct business so that when it comes time to transfer or replace a policy for a client, there are no legal violations in the process. For example, in New York state, the Department of Financial Services under Section 3425 of the New York Insurance Law[12] has detailed strict procedures for creating and getting approval of a carrier plan for withdrawal, and understanding this as a producer will better help you navigate this type of situation with your business and clients.

Policy transfers and replacements. As part of a carrier withdrawal, a producer will most likely have to transfer a client’s policy to another carrier or replace policies altogether. When doing so, producers must be mindful of the new policies they are securing—they should be equivalent, if not superior, in coverage to what the clients had previously. It also is important to notify a client of any changes, explain these changes, and receive client consent.

Fiduciary responsibilities. Insurance producers are fiduciaries, and they are required to act in the best interest of their clients. Make sure you are familiar with the fiduciary requirements of the states in which you conduct business, as well as any other heightened duty requirements imposed by your state. For example, in New Jersey, the outcomes of several state Supreme Court cases indicate that there is an expected heightened duty of care upon producers in the state to render advice to their clients regarding choices to be made concerning coverages and other information on their policies. This type of heightened duty will be important in situations, such as a carrier withdrawal.

Record-keeping and documentation. In general, it is best practice to maintain accurate and detailed records, including all communication with carriers and policyholders. The implications extend beyond just helping clients and your business navigate through a carrier withdrawal—quality record-keeping is a good idea in all instances for errors-and-omissions purposes.

Summing up

Handling these situations in an ethical manner are paramount to your business reputation and to the health of your client relationships. You can do so by providing honest and clear information about a carrier withdrawal and the options available to your clients. This also can be accomplished with awareness and full compliance when marketing policies, as well as staying informed and educated of legal and regulatory updates.

Keep in mind that to truly protect yourself and your business in the event of a carrier withdrawal, it is best for you to consult legal professionals representing your agencies or compliance experts in their field.

It is of utmost importance to stay connected to regulatory bodies, as well as PIA Northeast, as we will continue to monitor the market and producer feedback and provide updates to members should there be any developments involving a carrier withdrawal.

This article originally appeared in the April 2024 issue of PIA Magazine.

[4] Ibid.

[7] Ibid.

[9] Ibid.

[10] Ibid.

Danielle Caswell, Esq.

Danielle Caswell earned her bachelor’s degree from New York University and her law degree from Brooklyn Law School with a particular focus on intellectual property, information, and media law. Previously, Danielle was an associate at a law firm in New York City where she focused primarily on intellectual property and entertainment-related transactional and litigation matters.