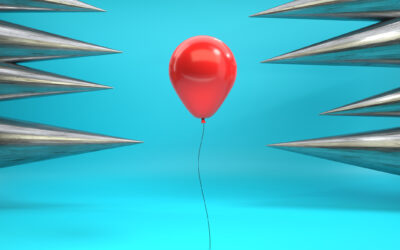

Amid growing concerns about the financial health and stability of the insurance marketplace, the personal-lines sector has experienced significant disruption, driven by carrier withdrawals and a rise in insolvencies. These developments are further constricting an already hardened market, reducing capacity, raising premiums and complicating efforts to secure coverage for clients.

This document offers a comprehensive overview of recent carrier exits affecting both the national and New York, New Jersey, Connecticut, New Hampshire and Vermont’s insurance markets.

Nationwide, carriers like Main Street America and AmGUARD have withdrawn from the personal-lines market. In New York state, insurers such as Adirondack Insurance Exchange, Mountain Valley Indemnity Co., and American Transit Insurance Co., have deteriorated. These shifts are critical for independent agents to understand as they navigate a more competitive environment, making it essential to remain informed and prepared while exploring alternative coverage options for clients.

The following sections provide key updates on carrier market withdrawals and insolvencies, as well as their broader implications for agents and the marketplace.

Carrier departures

Providence Mutual. Recently, Providence Mutual announced its intention to exit the personal- and commercial-lines auto insurance business in the four states where it currently offers coverage: Connecticut, New Hampshire, Rhode Island and Maine. Providence Mutual will transfer some of its business to Plymouth Rock Assurance, and Plymouth Rock will spearhead auto insurance renewal offers to eligible policyholders in Connecticut and New Hampshire. Auto insurance policies with renewal dates at the conclusion of March 2025 or early April 2025, would be the first to go through the process.

PIA recommends … PIA Northeast advises agents working with policyholders in Providence Mutual’s personal or commercial auto insurance lines to review their agency agreement with Providence Mutual. This review will help clarify any guidance provided for situations in which a carrier transfers business to another carrier.

Progressive. Progressive recently announced it will no longer offer dwelling fire insurance (also known as landlord insurance) for non-primary residences and rental properties, choosing instead to focus on owner-occupied homes and bundled home and auto insurance.

Main Street America Insurance. Main Street America has exited the personal-lines market for admitted carriers nationwide. The company plans to focus on commercial lines, where it sees more growth potential. Agents working with this carrier will need to start transitioning clients to other insurers. The shift in strategy adds to the pressures on available capacity in the personal lines market.

PIA recommends … PIA Northeast encourages agents to start transitioning affected Main Street America clients to alternative carriers willing to assume this business and to share insights on successful placements.

AmGUARD Insurance. Effective July 8, 2024, AmGUARD Insurance Co., stopped accepting new submissions for homeowners and personal umbrella policies nationwide and it will begin nonrenewing existing policies in accordance with state laws, as it shifts its focus to commercial lines. AmGUARD has pledged to provide further details on state-specific timelines to ensure full compliance with state regulations throughout the withdrawal process.

PIA recommends … PIA Northeast strongly encourages agents and brokers to proactively manage this transition by securing alternative carriers well before clients’ nonrenewal dates.

Adirondack Insurance Exchange and Mountain Valley Indemnity Co. Adirondack Insurance Exchange and Mountain Valley Insurance are both exiting the New York state insurance market, which started in October 2024. AIE’s departure is driven by ongoing financial struggles, including rising loss costs and unmet rate increases, which have made it difficult for the company to remain competitive. AIE began nonrenewing policies in October: any remaining policies are to be canceled by the end of 2024. Due to AIE’s deteriorating financial health, which no longer meets the requirements of many mortgage lenders, agents are strongly encouraged to transition policyholders to alternative carriers as soon as possible.

Similarly, Mountain Valley Insurance—while maintaining its financial stability—also is exiting the market. The expiration of MVIC’s reinsurance agreement with AIE on July 1, 2024, raises concerns about potential future impacts from AIE’s instability. MVIC also started nonrenewing policies in October, with all policies to be terminated by the end of the year. Agents are advised to transfer their clients to other carriers to avoid potential risks associated with AIE’s financial constraints.

Carriers facing insolvency

American Transit Insurance Co. The New York State Department of Financial Services has ordered American Transit Insurance Co., the New York City’s largest insurer of taxis, Uber and Lyft vehicles, and other for-hire vehicles, to take immediate steps to resolve its insolvency. In a letter to the company, the DFS instructed ATIC to explore all possible options for securing additional capital, including a potential sale, and to submit a detailed remediation plan within 90 days. ATIC’s financial reports have long indicated a steady decline in the company’s financial health.

PIA recommends … PIANY advises agents who write policies for taxis and commercial for-hire vehicles, including black cars, Uber and Lyft, to proactively begin transitioning affected clients to alternative insurance carriers willing to take on business from ATIC. Given the uncertainty surrounding ATIC’s financial future, it is crucial for agents to act swiftly in protecting their clients from potential coverage disruptions.

PIANY will continue to closely monitor ATIC’s efforts to address its insolvency, whether through securing additional capital or exploring a potential sale. Agents will be kept informed of any significant developments, ensuring they have the latest information to guide their clients through this challenging period. As ATIC navigates this financial instability, PIANY remains committed to supporting its members with timely updates and resources to mitigate the impact on their business.

Impact on the market

The exits of Main Street America, AmGUARD, AIE and MVIC, along with the pending insolvency of American Transit, are substantially reducing capacity in the insurance market. With fewer carriers offering coverage and agents facing greater challenges in placing policies, policyholders are likely to encounter sharp premium increases and stricter underwriting criteria. As the market hardens further, it is essential for agents to remain proactive in securing alternative carriers for their clients.

PIA recommends …

PIA Northeast is monitoring these developments closely and the association remains available to assist its members during this period of transition.

We encourage you to share any challenges or successes in finding alternative coverage, as this will help us advocate more effectively on your behalf. Your feedback is invaluable in helping us track market trends and identify effective solutions for clients. Please send your feedback to: resourcecenter@pia.org.

Here is a current list of articles on PIA Northeast News & Media that cover carrier actions:

PIANY, DFS continue discussions on carrier exits from N.Y. marketplace

When carriers withdraw from a market

PIANY meets with DFS to discuss Adirondack and Mountain Valley’s marketplace exit

From PIANY President Gary Slavin, re: Adirondack, AmGuard leaving markets

Adirondack Insurance Exchange announces departure from New York insurance market

AmGUARD Insurance Co. withdraws from personal-lines marketplace, effective July 8

Adirondack Insurance Exchange financial stability: What policyholders need to know

CID bulletin: Carriers’ responsibilities when they discontinue, reduce line of business

Theophilus Alexander

Theophilus W. Alexander has served in both houses of the New York State Legislature. He worked as a legislative analyst for Hon. New York State Sen. Samra G. Brouk, D-55, and he served at the New York State Assembly, as a policy analyst with New York Assembly Program & Counsel. Theo received his Bachelor of Arts degree in Politics from Ithaca College in Ithaca, N.Y.